European insurance coverage tech startup Wefox has raised $400 million in a collection D spherical of funding, giving the German firm a post-money valuation of $4.5 billion. This represents a 50% enhance on last year’s $3 billion valuation at its collection C spherical.

Based out of Berlin in 2015, Wefox sells numerous insurance coverage merchandise by way of a mixture of in-house and exterior brokers, bypassing the direct-to-consumer mannequin of insurtech opponents which embrace rival German startup Getsafe. This fashion of rising customers, by getting third-party brokers to make use of Wefox to advise their very own prospects, is how CEO and founder Julian Teicke reckons helped the corporate double its revenues to $320 million final 12 months. Furthermore, it has already generated $200 million within the first 4 months of 2022, placing it heading in the right direction to hit $600 million in turnover by the tip of the 12 months, and just lately handed 2 million customers across the board.

So far, Wefox stated it has constructed a community of round 3,000 unbiased brokers in its native Germany, whereas in different markets equivalent to Switzerland, Germany, and Austria, it has skilled its personal brokers.

“Wefox’s ‘secret sauce’ is in its enterprise mannequin of oblique distribution, which has enabled the corporate to scale sooner than another insurtech on this planet,” Teicke advised TechCrunch. “Our mannequin is exclusive within the insurtech house, since all others go direct to shopper.”

Buyer acquisition

The primary profit to this mannequin lies in the price of buying prospects, which turns into considerably decrease provided that its brokers, brokers, and different companions do a lot of the spade-work for Wefox. Furthermore, this additionally permits Wefox to enter new markets extra rapidly.

“We will then deal with enabling our brokers, brokers, and affinity companions to focus on essentially the most worthwhile prospects, which improves our loss ratios and buyer lifetime worth,” Teicke added. “Our mannequin allows Wefox to drive a superior monetary profile which places us on a transparent path to profitability.”

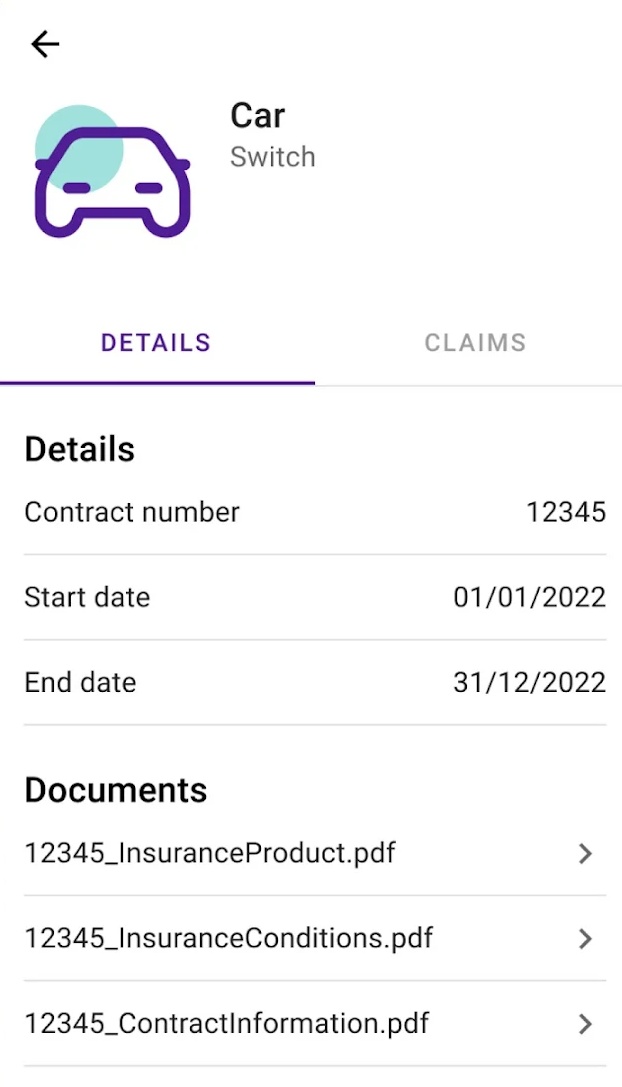

The strategy is constructed on the fundamental notion that insurance coverage is an inherently complicated topic, and folks would slightly chat with a human and get customized recommendation. And solely then does the expertise kick in, with all the same old cell apps and on-line dashboards for registering and submitting claims.

Wefox

Downturn

Few industries are impervious to the financial downturn, and insurtech is no different. Up to now month alone, Policygenius cut a quarter of its workforce shortly after elevating $125 million, whereas Next Insurance is scaling back by around 17%. Elsewhere, a host of publicly-traded insurtech companies are buying and selling manner down on their preliminary IPO worth, together with Root, Hippo, and Lemonade, the latter additionally reportedly shedding a portion of its staff back in April.

On the flip-side, we now have seen some bumper investments within the insurtech house, with Department just lately attracting a $147 million series C tranche at a $1.05 billion valuation, whereas YuLife snagged $120 million at a $800 million valuation simply final week. Throw into the combination the steady stream of smaller investments into the house, and it’s clear that even when 2022 doesn’t observe within the footsteps of the bumper 2021, insurtech isn’t exactly dead in the water.

From Wefox’s perspective, it has solely been a 12 months because it raised a $650 million spherical of funding, so it’s troublesome to think about that it might’ve burned by way of that a lot money in such a brief time frame. And, it appears, it hasn’t — in accordance with Teicke, it wasn’t determined to lift once more, it’s merely future-proofing itself ought to it want the funds.

“We don’t want any additional cash, nonetheless following our collection C spherical, traders approached us and beneath the present financial local weather we imagine it was prudent to assessment the state of affairs and reap the benefits of the present financial downturn — as a result of we see this as a chance to develop even sooner,” Teicke stated.

Wefox’s collection D spherical, which is compromised of fairness and debt, was led by Mubadala Funding Firm, with participation from LGT, Horizons Ventures, and Omers Ventures. Flush with money, the corporate stated that it plans to enter new European markets in 2022, with long term plans to develop into the U.S. and Asia in 2024.